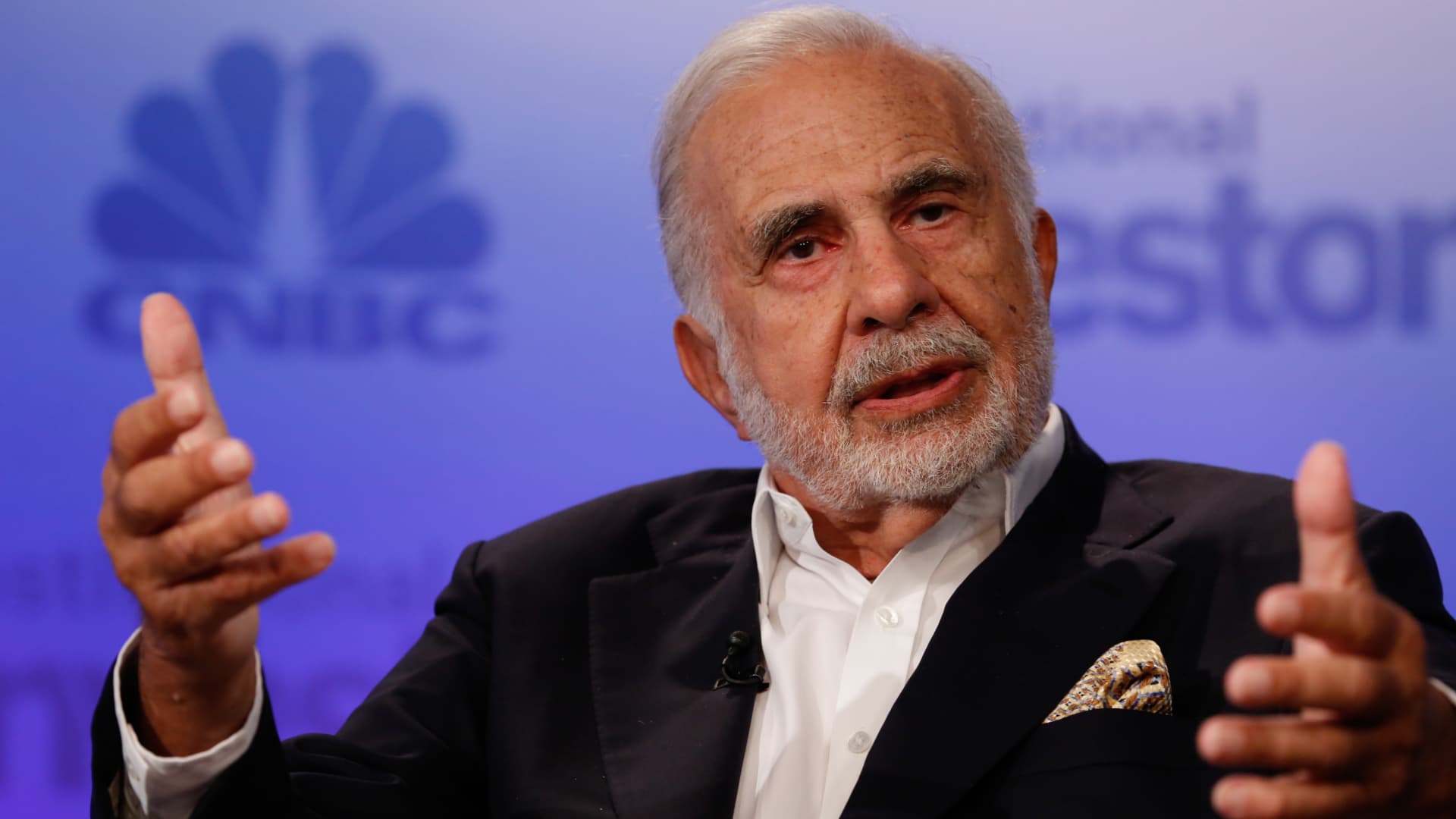

Carl Icahn on Wednesday said Illumina should bring back its former CEO “immediately,” his latest move in a brewing proxy fight with the biotech company.

Icahn said in an interview with the Wall Street Journal that the former top exec Jay Flatley “obviously knows the company and did a good job with it.” The activist investor did not specify whether he was in contact with Flatley.

Flatley helmed the DNA sequencing company for 17 years before he was succeeded by current CEO Francis deSouza in 2016. San Diego-based Illumina credits Flatley for the company’s high growth in the past two decades, noting that he took the company from $1.3 million in sales in 2000 to $2.2 billion in 2015. Flatley served as executive chair and later chairman of Illumina’s board until 2021.

Illumina shares popped nearly 4% Wednesday morning.

Icahn, who owns a 1.4% stake in Illumina, lambasted the company’s current management in the interview. He told the Journal that executives are making the mistake of holding onto Illumina’s $7.1 billion acquisition of cancer test developer Grail in 2021.

Icahn has been pushing for Illumina to unwind the “disastrous” deal, which he claims wiped out $50 billion in the company’s market value. He told the Journal that Illumina can’t afford to keep Grail under current macroeconomic conditions.

“They don’t have the money, and especially in this environment, they won’t be able to keep funding this money-losing business,” he said. “I hate to say this, but this company is on a road downhill like the Eastman Kodaks of the world if they don’t get rid of Grail and focus on their core business.” Icahn was referring to a photography pioneer that descended into bankruptcy in 2012.

“This is an urgent moment for the company and they need someone who knows what they’re doing to fix the situation,” he told the Journal.

Part of Icahn’s opposition stems from Illumina’s decision to close the Grail deal without approval from antitrust regulators. Illumina prevailed over the U.S. Federal Trade Commission’s opposition to the deal in September, but is still fighting for approval from the EU’s executive body, the European Commission.

The European Commission last year blocked Illumina’s acquisition of Grail over concerns it would stifle innovation and hurt consumer choice. The commission also unveiled details of a planned order that would force Illumina to unwind the deal.

In the interview, Icahn said the best way to liquidate Grail would be through a rights offering that allows Illumina shareholders to decide whether they want to invest in Grail or not.

“The best part of a rights offering is you find a way to fund Grail without adding debt to Illumina,” he told the Journal. “It’s a way to allow Illumina shareholders to get the benefit of buying Grail at a possible bargain price or sell their rights and get a benefit in this fashion.”

Illumina and Icahn did not immediately respond to a request for comment.