In this weekly series, CNBC takes a look at companies that made the inaugural Disruptor 50 list, 10 years later.

In 2013, the idea of an app for mental health-care may have seemed novel, if not monumental in terms of a global challenge for a disruptive start-up. But times have changed. A global pandemic that led to a massive spike in mental health challenges, and the acceleration in adoption of technology-based health care, make what start-ups like Ginger.io set out to do more than a decade ago seem ahead of their time.

Globally, the World Health Organization estimates approximately 1 billion people are living with a mental disorder, and that the vast majority of those in low- and middle-income countries where mental, neurological and substance abuse disorders receive no treatment at all. The supply-demand imbalance for mental health care surged since the Covid-19 pandemic. One Lancet study estimated that 53 million additional cases of major depressive disorders and 76 million additional cases of anxiety disorders globally in 2020.

Ginger.io, which grew out of an MIT Media Lab team focused on aggregating and analyzing health care data, was featured on the inaugural CNBC Disruptor 50 list in 2013 for leading the way in creating a data-driven, on-demand digital mental health ecosystem. It became a unicorn in 2021 after a $100 million funding round led by Blackstone.

At the time of the deal, Ginger reported revenue that had tripled year-over-year for three consecutive years and more than 500 employer customers including Paramount, Delta Air Lines, Domino’s, SurveyMonkey, Axon, 10x Genomics, and Sephora, as well as deals with corporate health-care concierge company Accolade and upstart online pharmacy Capsule.

The company said demand for its services increased three-fold during the pandemic, but as the scale of the mental health-care issue has grown, the start-ups tackling it have had to scale, too. Late in 2021, Ginger merged with an app-based business many people looking for some calm during Covid had come to know: meditation app Headspace.

The $3 billion merger of Headspace Health and Ginger was part of a larger consolidation trend within the digital health care space and movement by disparate health tech businesses to roll up a full suite of services under a model known as value-based care. Other original CNBC Disruptors — Castlight Health, which merged with Vera Whole Health, and Audax (now part of health giant UnitedHealth’s tech-based business Optum) — were among a recent wave of deals among some of the best known health tech start-ups. Virgin Pulse and Welltok. Accolade buying PlushCare. Grand Rounds and Doctors on Demand. Teladoc and chronic care company Livongo.

The combined Headspace-Ginger entity reaches nearly 100 million lives across 190-plus countries through direct-to-consumer business and 3,500+ enterprise and health plan partners.

“The increase in need is staggering,” said Russell Glass, CEO of Headspace Health. ”You’ve gone from 20% of the [U.S.] population with a need to 40%, so a doubling of those with an acute anxiety, depression or other mental health need.”

Headspace Health clients include Starbucks, Adobe, Delta Air Lines and Cigna.

“Mental health is clearly a global challenge,” said Karan Singh, COO of Headspace Health. And it is a challenge that includes business complexity, from varying regulations around the world to language-based needs. “Everyone may use a different language to describe things that they are going through, but this is something that most everyone is going through,” Singh said.

In the U.S., as the pandemic continues and regulations evolve, Headspace Health faces the challenge of getting lawmakers to view telehealth in the same category as traditional health care.

The Biden administration is focusing on mental health among other health-care priorities, including plans to decrease restrictions to practice virtually across multiple states, a step Glass said is long overdue and critical in building a mental health infrastructure that is equitable economically, racially and geographically.

“Solving this crisis should and can be our next JFK moonshot moment,” Glass said.

“I do think we are going to need some structural changes to ensure that some of the gains we’ve seen over the past few years actually persist,” added Singh.

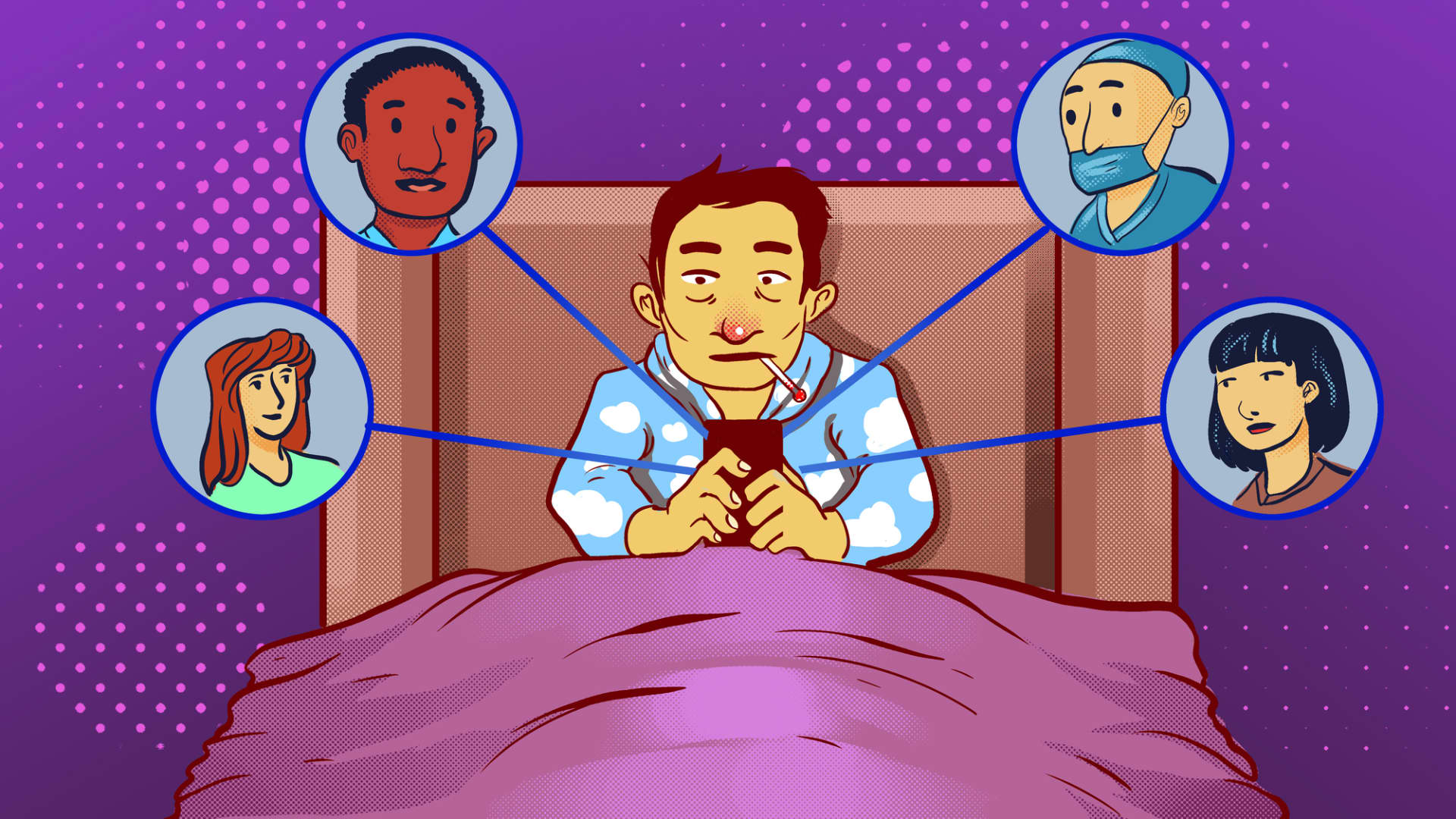

Virtual care has become a powerful and effective way for accessing care, and many people prefer it to in-person care, or at least to have the option.

“The cat’s out of the bag,” Glass said. “As consumers realize just how amazing telehealth is, and as the government bodies hear more and more from those consumers, we’re going to see change happen.”

Glass compares Headspace’s current regulatory struggle to the one faced by Uber, and cited how consumer preferences inspired regulatory change.

But the digital health space is facing more acute market challenges, with its post-pandemic playbook being questioned, highlighted by this week’s disastrous earnings results from Teladoc, which included a more than $6 billion write down related to its acquisition of Livongo. Some of the most prominent names to go public associated with digital health have seen their public market values decimated over the past year, including Teladoc, Hims and Hers Health, and American Well, as core telehealth services become commoditized and the market opportunity among corporate buyers and insurers willing to pay more for a full suite of digital health care seems less assured.

Headspace Health sees room for both competitors, and more deal-making.

“We want to transform mental health care to improve the health and happiness of the world. We’re not going to do it alone,” Glass said. “A healthy competitive environment is critical to accomplish what we want to accomplish.”

Earlier this year, Headspace acquired Sayana, an AI-driven wellness company, further increasing the breadth of services and scope of care into its portfolio.

As it attempts to increase access to mental health care services, the ultimate goal is to drive costs lower.

“How do we take the cost out of care? How do we keep people from needing higher levels of care?” Glass said.

Singh provided the answer. “Focus on prevention. Ultimately, that’s the only way out of this,” she said.

—By Zachary DiRenzo, special to CNBC.com

Sign up for our weekly, original newsletter that goes beyond the annual Disruptor 50 list, offering a closer look at companies like Headspace and entrepreneurs like Glass and Singh who continue to innovate across every sector of the economy.